ROOTED IN CREDIT

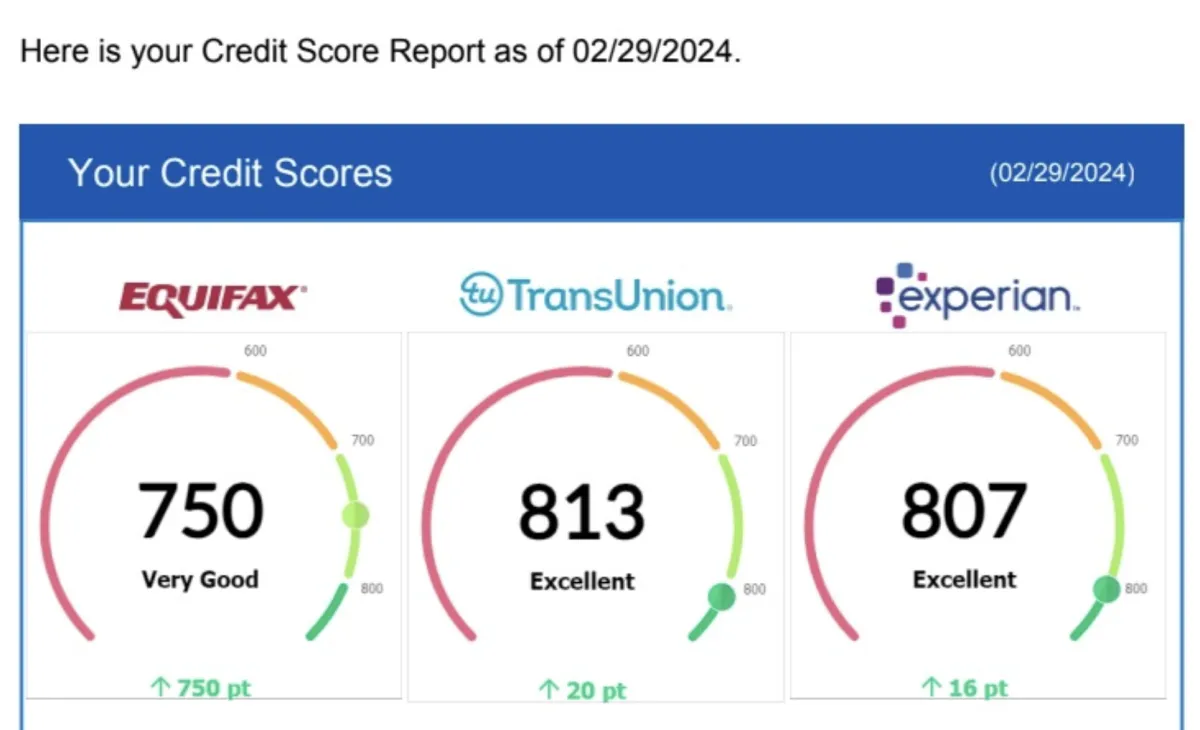

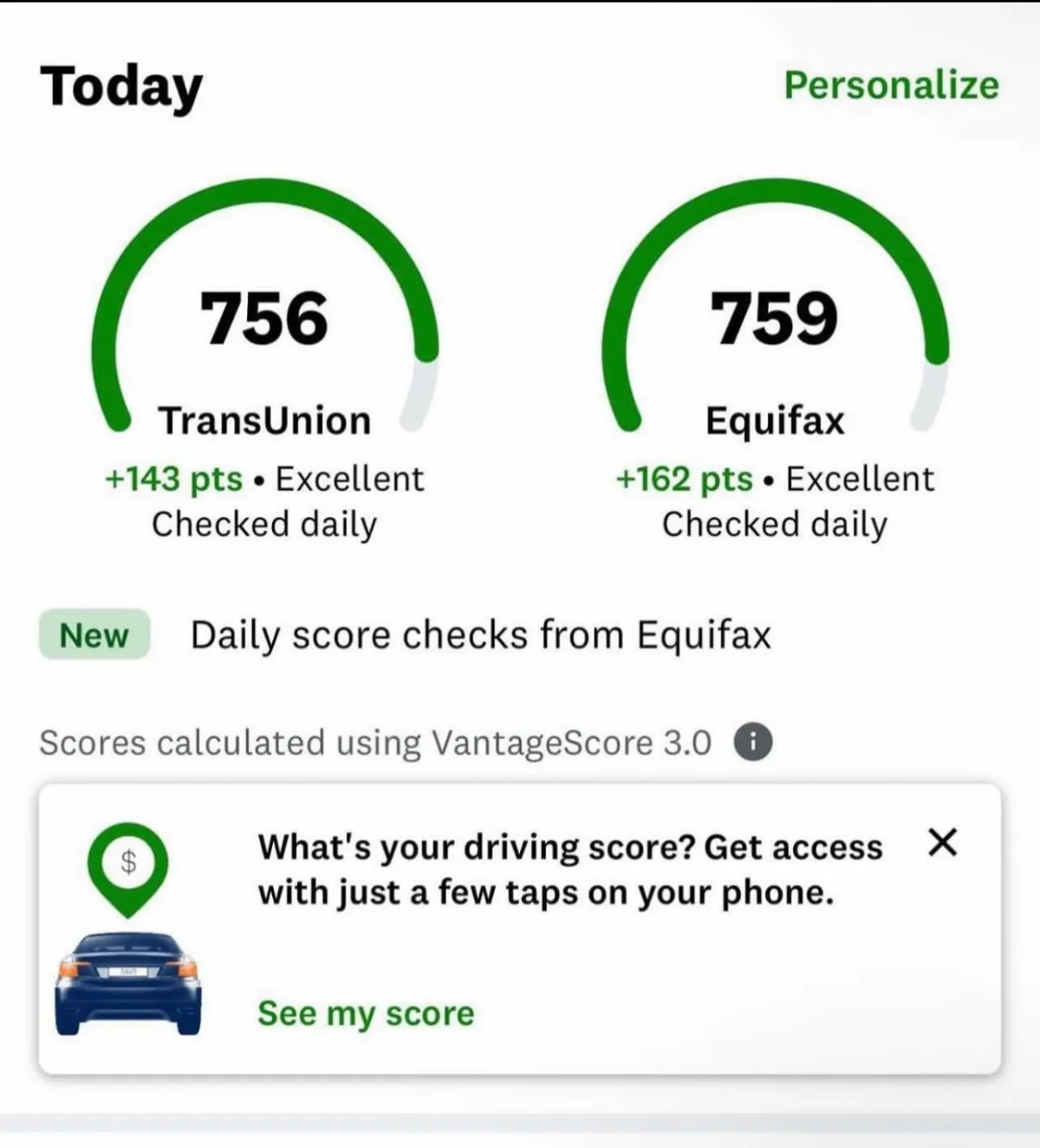

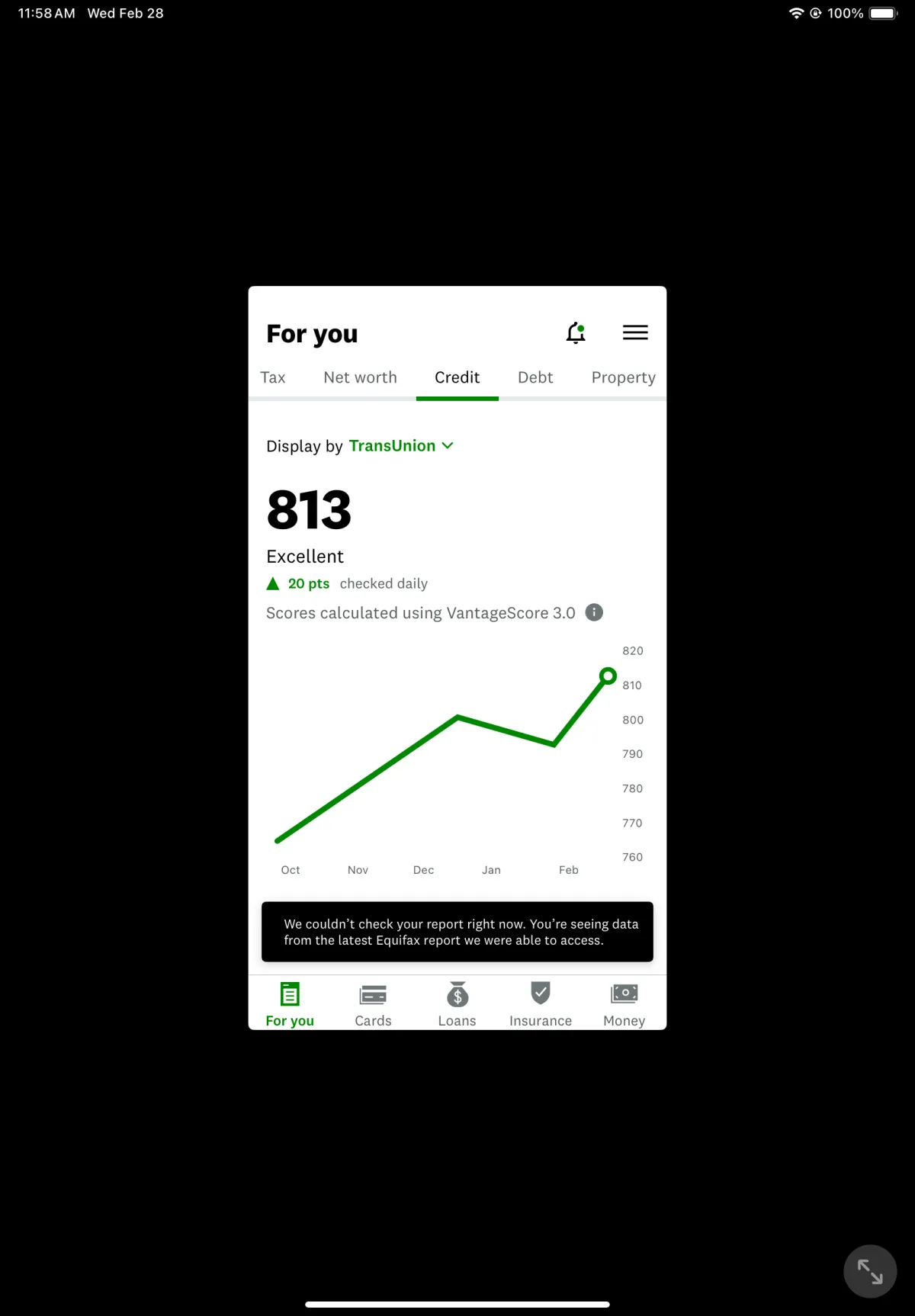

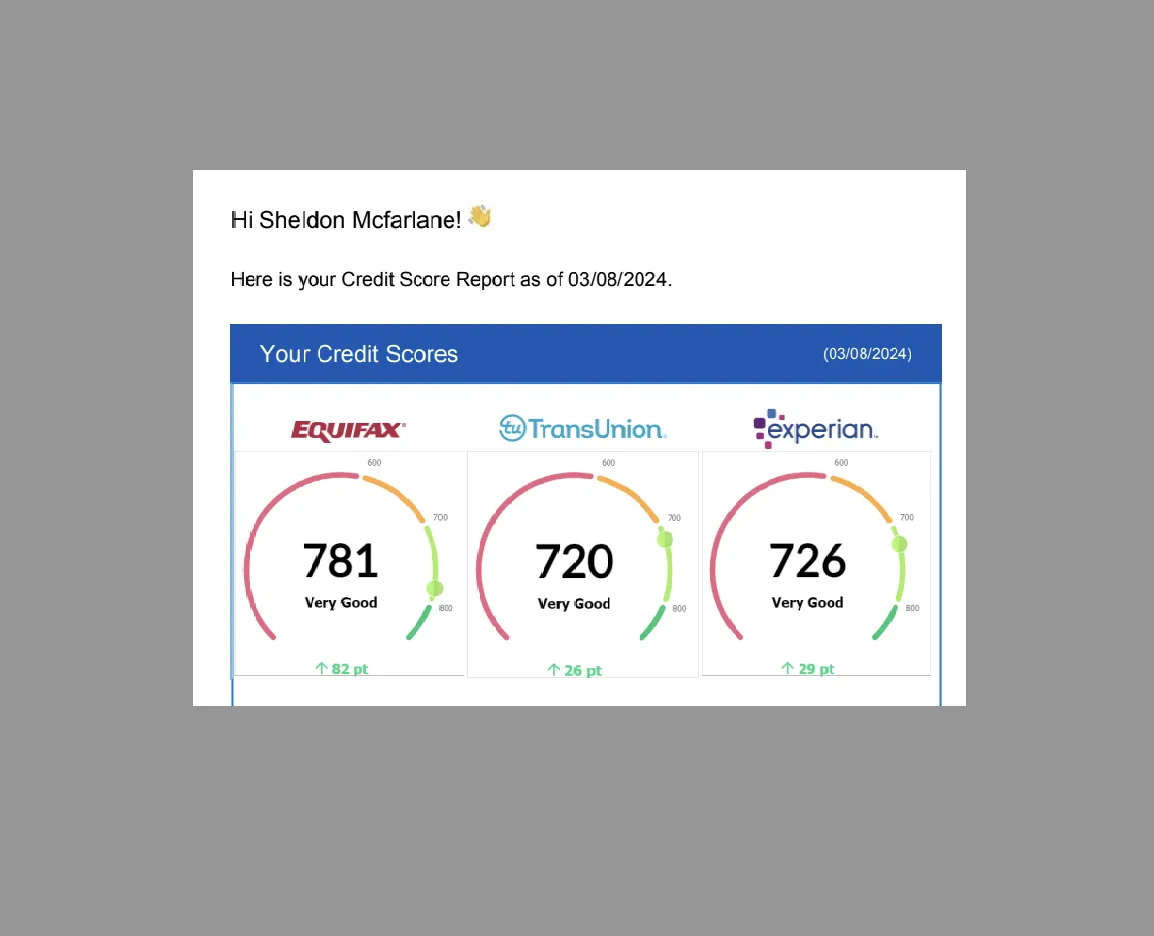

Ready to Build a 720+ Credit Profile — and Unlock Real Funding Opportunities?

🏆 What’s Included

✅ FREE Credit Repair Services

Stay subscribed and get full credit dispute and cleanup services included — no extra fees. We handle the heavy lifting while you focus on building your future.

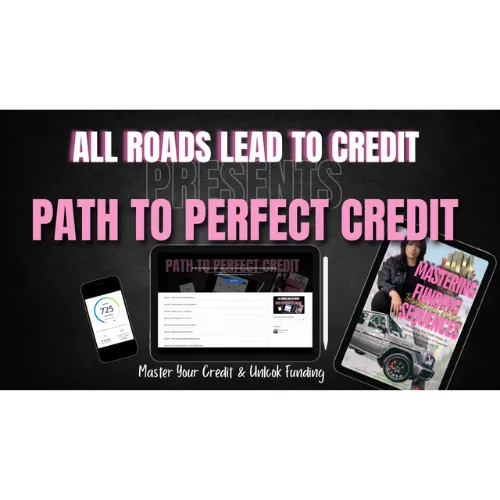

✅ Full Access to the Path to Perfect Credit Course 29 easy-to-follow lessonsbroken down into short, powerful modulesLearn how to read and structure your credit reports

✅ Master the difference between FICO and VantageScoresUnderstand what drives your score — and how to raise it fastBuild a clean, fundable credit profile ready for major approvalsLearn real funding sequences to secure $20K–$100K+ in personal funding

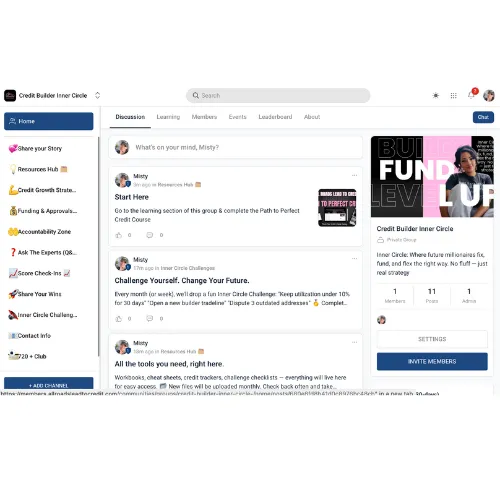

✅ Exclusive Membership in the Credit Builder Inner Circle Get access to our private client-only community, including:

Choose the Credit Builder Program that fits your journey

Set up your client portal and course access (password will be sent via email)

Start building smarter with our expert support

Watch your credit profile — and opportunities — grow

8 full sections

29 total lessons

Interactive checklists and resources

Private group support inside the Inner

Circle Immediate access after enrollment

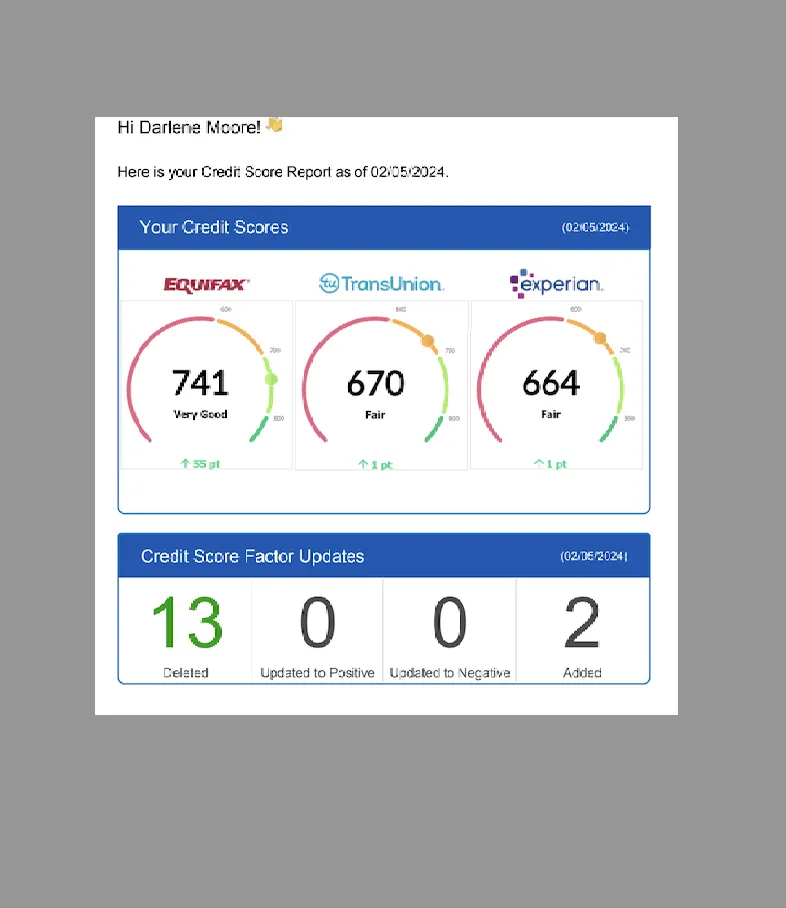

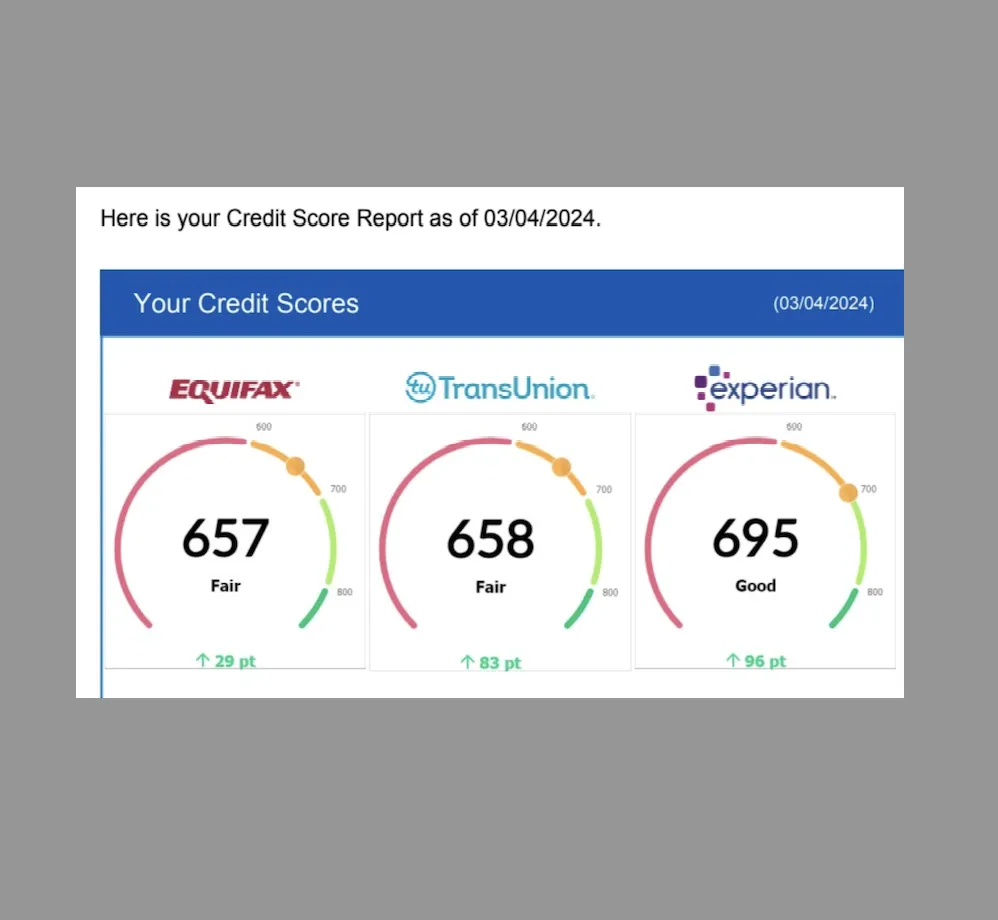

Welcome to All Roads Lead to Credit, where we pave the way to financial freedom! In today's world, navigating the complexities of credit is essential in almost every aspect of life. Whether you're buying a home, signing up for a new electric bill, car shopping, or insurance shopping, everything in the United States is attached to your personalized credit report and FICO score data. At All Roads Lead to Credit, we understand that no matter which road you take in life, it will inevitably lead you to the realm of credit. That's why we're here to empower you with affordable and knowledgeable credit programs designed to break down financial literacy barriers and guide you towards a brighter financial future. This addition reinforces the importance of understanding and managing credit in various aspects of life, while also emphasizing the necessity of your credit services.

Personal Coaching Priority Programs

Silver Program

Gold Program

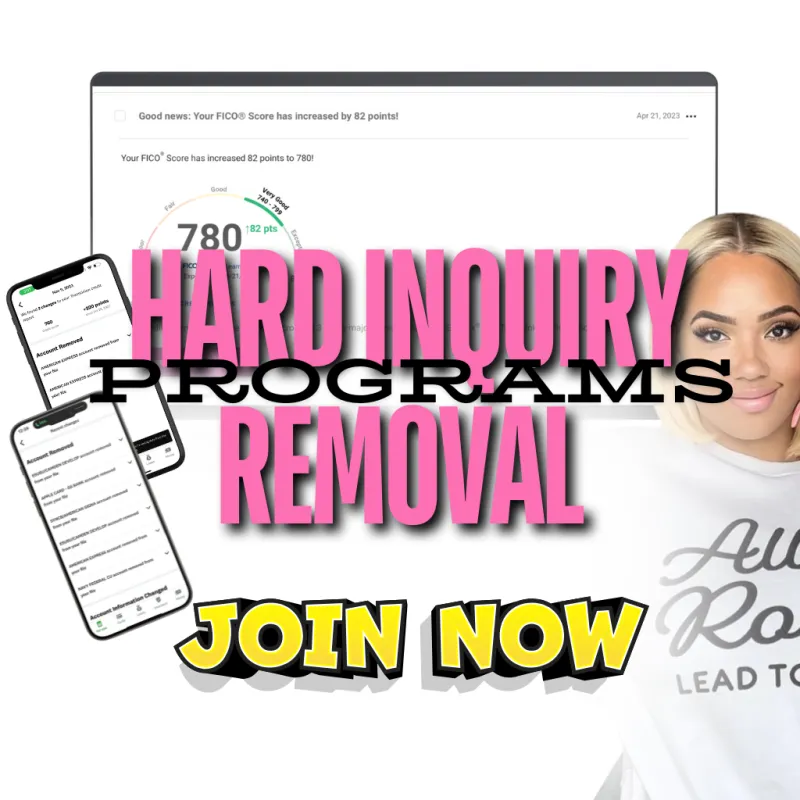

Hard Inquiries Removal Options

General Admission

One time Enrollment Fee $347

Removal of ALL non- account holding hard inquires

All 3 credit bureaus Include (TransUnion, Experian and Equifax

Guaranteed completion within 45 days of joining.

Express Delivery

One time Enrollment fee $647

Removal of ALL non- account holding hard inquires

All 3 credit bureaus (TransUnion, Experian and Equifax

Guaranteed completion within 2.5 weeks of joining.

No limit Monthly Pass

Unlimited Non account holding Hard Inquiry removal Enrollment $147 & $47.97 month until canceled

All 3 credit bureaus (TransUnion, Experian and Equifax

Guaranteed monthly completion.

Your Wealth, My Mission: Navigating Your Business Needs Together

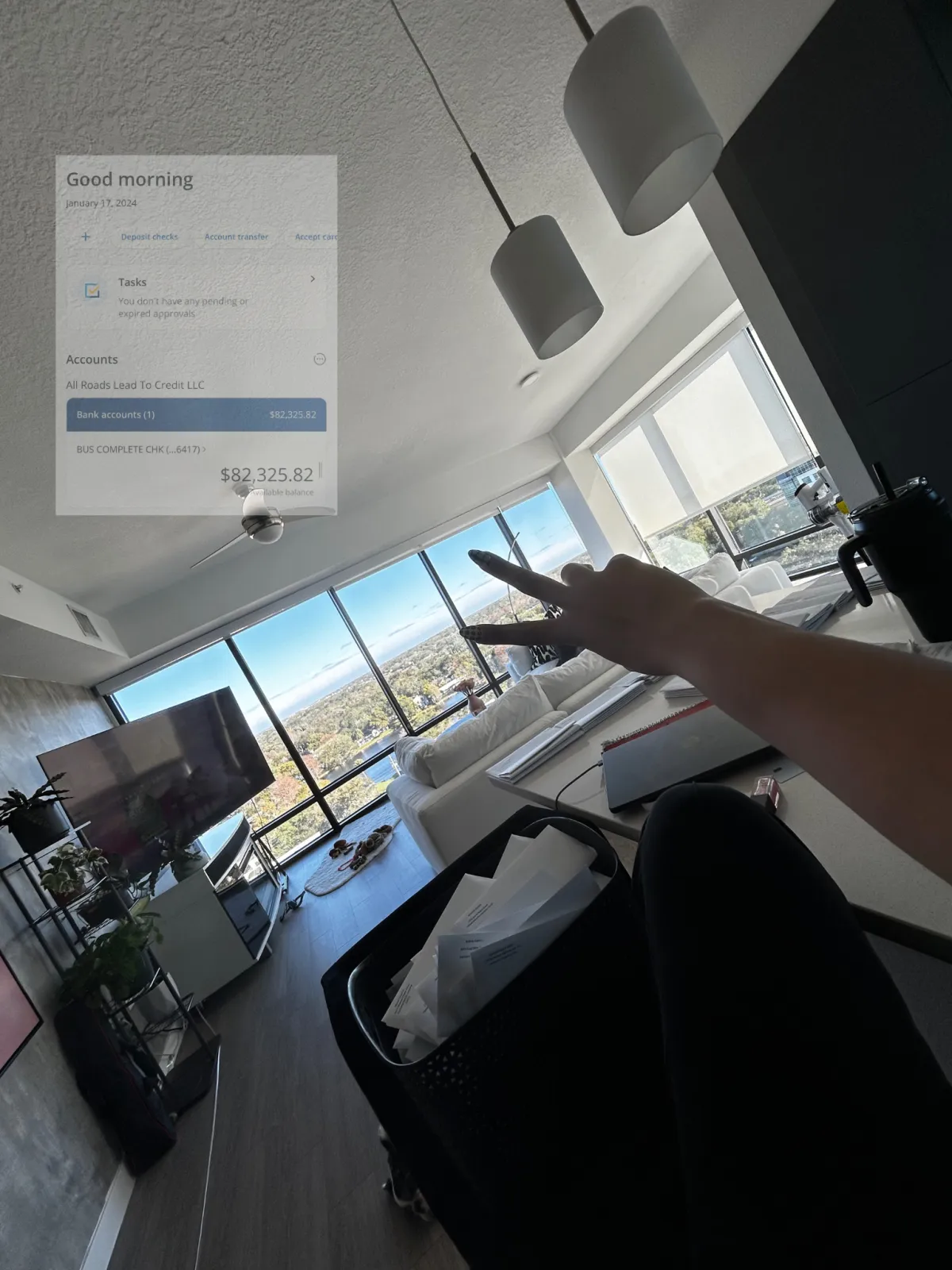

Interested In Business Funding?

At All Roads Lead to Credit, we believe in empowering businesses of all sizes to achieve their financial goals. Whether you're a startup looking to gain traction or an established company aiming for expansion, your tailored funding programs are designed to meet your needs.

Using business credit and funding comes with significant advantages. Your business becomes eligible for higher credit limits and lines. Typically, your utilization and other remarks don't get reported, except in cases of defaulting on agreements, which is rare. Additionally, you can access fantastic 0% interest opportunities, along with even greater rewards for travel and cash back.

If you intend to utilize credit for business funding or investments, it's advisable to do so through your business to safeguard your personal credit and reap the significant benefits of business credit mentioned earlier However, it's crucial to understand that the process of establishing and scaling your business credit correctly begins with first establishing and scaling your personal credit. You can then leverage your personal credit to establish and scale your business credit effectively.

Creditors will check your personal credit cards and loans, including details such as actual approvals, size of credit lines, and terms, as part of their assessment process.

Attempting to apply for business credit too early may result in smaller credit lines and missing out on valuable 0% offers. More importantly, it can waste time that could have been better spent establishing and scaling your credit lines to a size sufficient to fund your entire business investment without incurring high utilization.

Before venturing into business credit, it's essential to meet certain minimum prerequisites. Click below for more information.

90-Day Money-Back Guarantee!

Behind the Scenes: Meet Misty Rose Schroeder, Owner and Founder of All Roads Leads to Credit

Because good credit isn’t a dream — it’s a blueprint. And you’re about to build it.

Perfect for clients rebuilding credit — does not include public record removals.

This program is ideal for those dealing with collections, charge-offs, late payments, and other negative items excluding bankruptcies, evictions, or other public records.

Full 3-bureau credit report review

Monthly dispute processing

Personalized credit-building plan

Client portal access

Path to Perfect Credit course

Credit Builder Inner Circle (community access)

Email support (no calls)

Payment Options:

$287 to start + $89.88/month

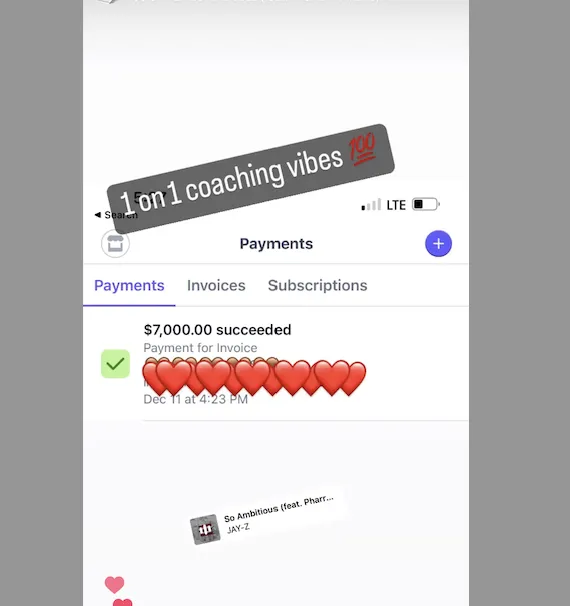

$1247 one-time (express 1 on 1 coaching

Best for clients with public records like bankruptcies, evictions, or judgments.

If your report includes public records or severe derogatory items, this is the programyou need. Gold includes

everything in Silver plus public record removals.

All Silver Program benefits

Public record dispute processing

Priority support + faster dispute handling

Enhanced strategies for deeper credit repair

Payment Options:

$397 to enroll + $97.88/month

$1747 one-time Express

General Admission

One time Enrollment Fee $347

Removal of ALL non- account holding hard inquires

All 3 credit bureaus Include (TransUnion, Experian and Equifax

Guaranteed completion within 6o days of joining.

Express Delivery

One time Enrollment fee $647

Removal of ALL non- account holding hard inquires

All 3 credit bureaus (TransUnion, Experian and Equifax

Guaranteed completion within 2.5 weeks of joining.

No Limit Pass

Unlimited Non account holding Hard Inquiry removal

Enrollment $147.97 & $47.97 month until canceled

All 3 credit bureaus (TransUnion, Experian and Equifax

Guaranteed monthly completion.

At All Roads Lead to Credit, we believe in empowering businesses of all sizes to achieve their financial goals.

Whether you're a startup looking to gain traction or an established company aiming for expansion,

our tailored funding programs are designed to meet your needs.

Using business credit and funding comes with significant advantages. Your business becomes eligible for higher credit limits and lines. Typically, your utilization and other remarks don't get reported, except in cases of defaulting on agreements, which is rare. Additionally, you can access fantastic 0% interest opportunities, along with even greater rewards for travel and cash back.

If you intend to utilize credit for business funding or investments, it's advisable to do so through your business to safeguard your personal credit and reap the significant benefits of business credit mentioned earlier

However, it's crucial to understand that the process of establishing and scaling your business credit correctly begins with first establishing and scaling your personal credit. You can then leverage your personal credit to establish and scale your business credit effectively.

Creditors will check your personal credit cards and loans, including details such as actual approvals, size of credit lines, and terms, as part of their assessment process.

Attempting to apply for business credit too early may result in smaller credit lines and missing out on valuable 0% offers. More importantly, it can waste time that could have been better spent establishing and scaling your credit lines to a size sufficient to fund your entire business investment without incurring high utilization.

Before venturing into business credit, it's essential to meet certain minimum prerequisites. Click below for more information.

Purchase Books and Course Here

Purchase Books and Course Here

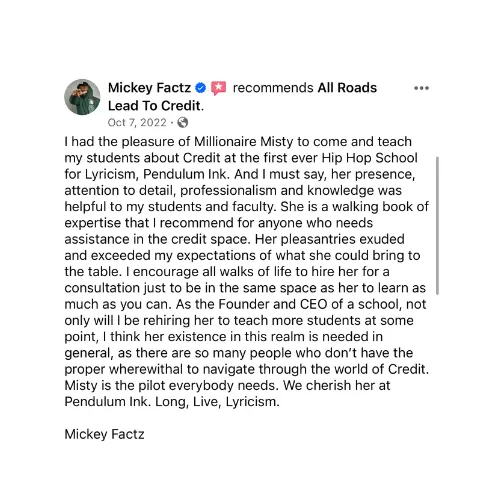

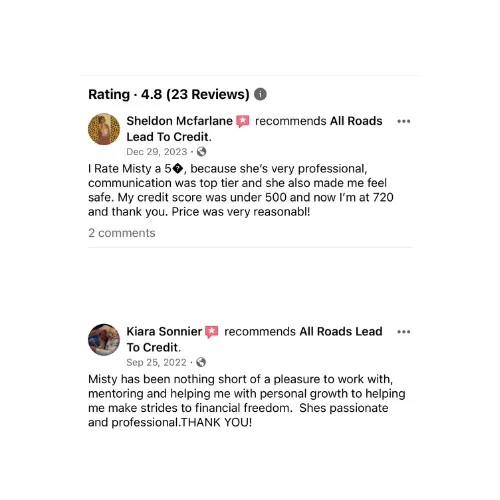

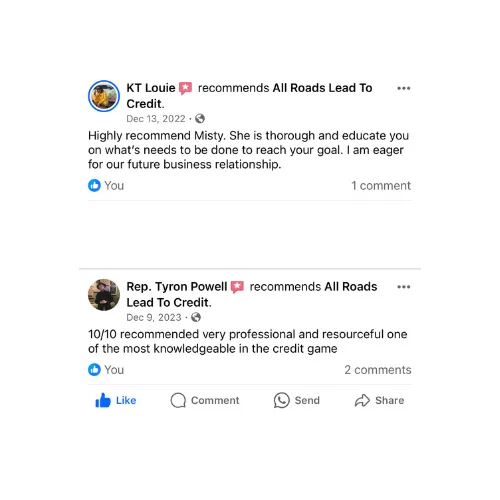

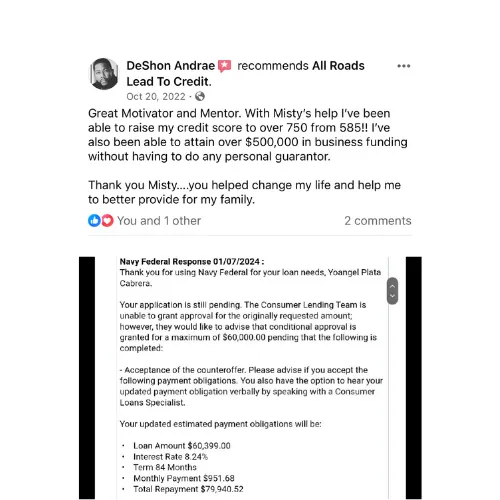

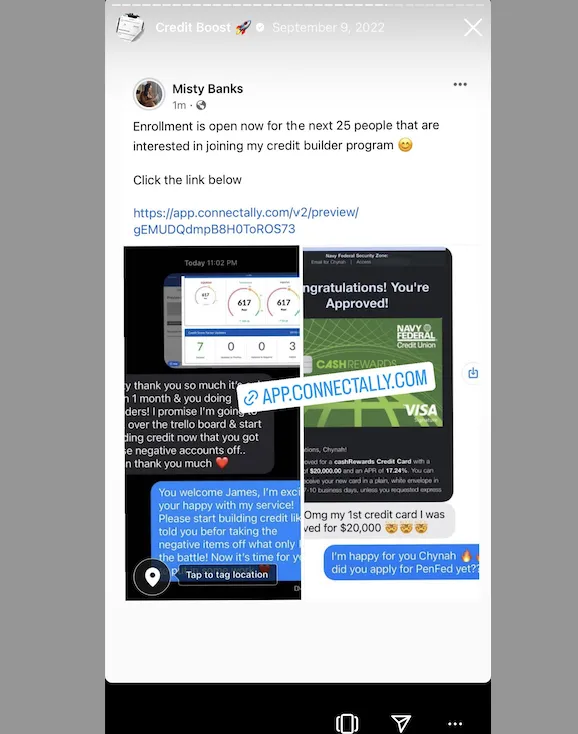

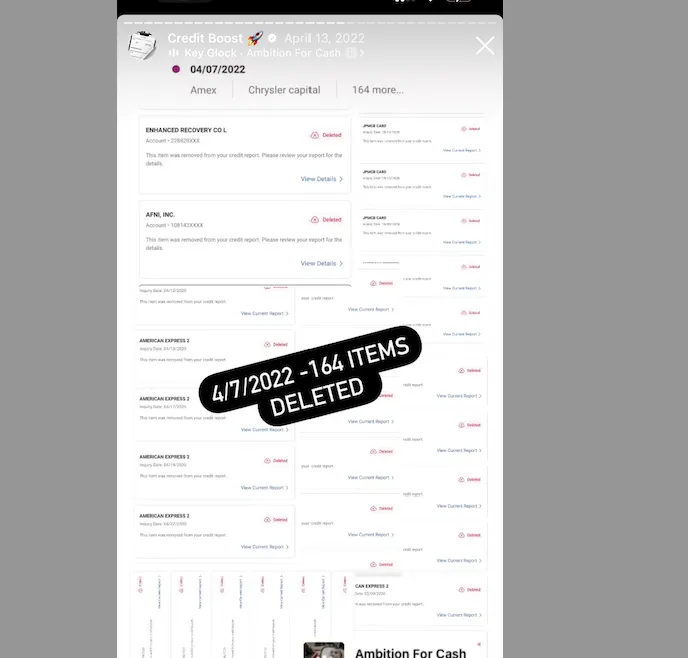

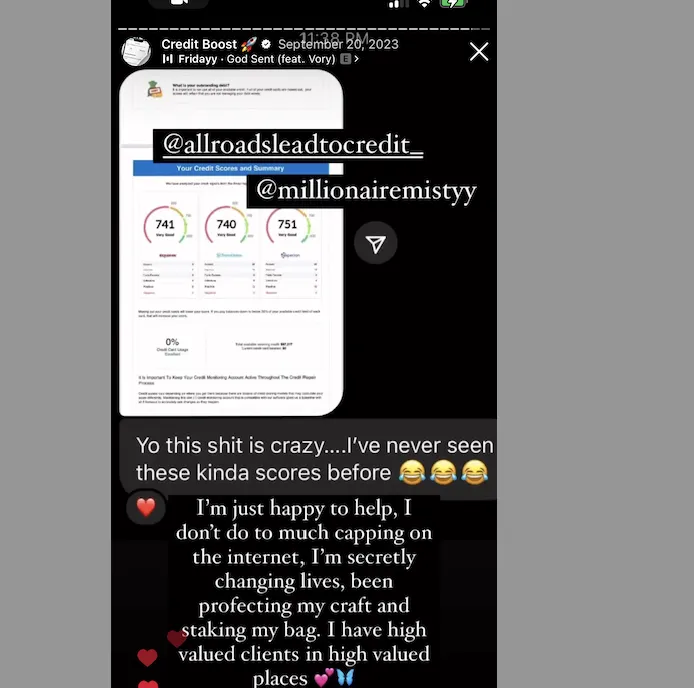

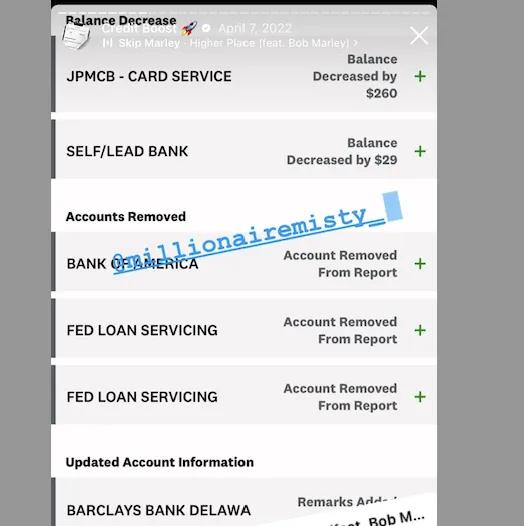

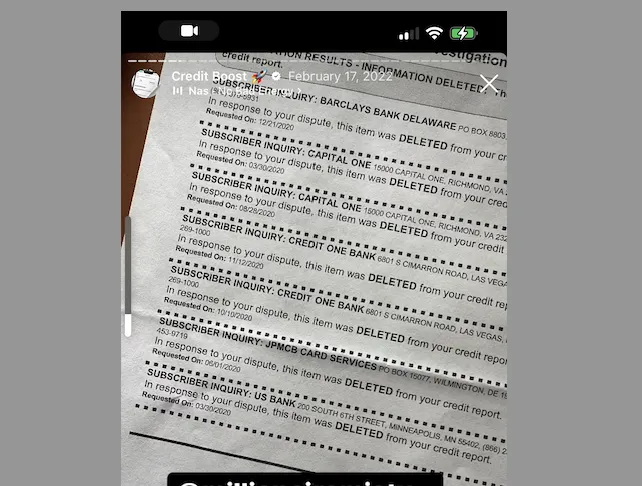

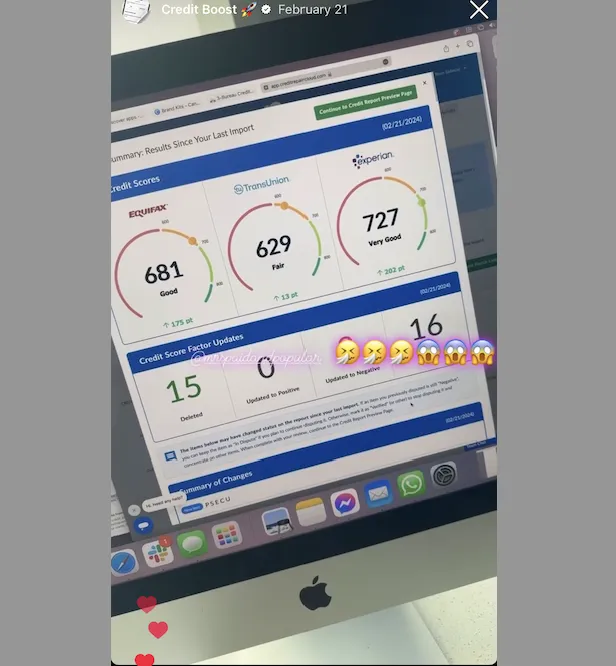

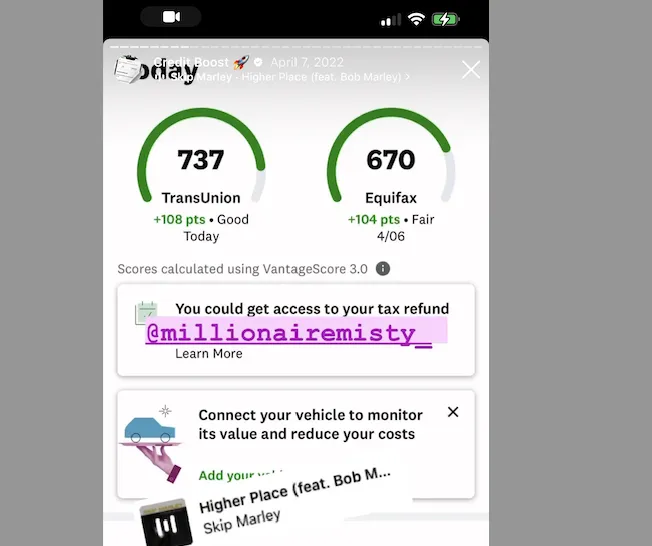

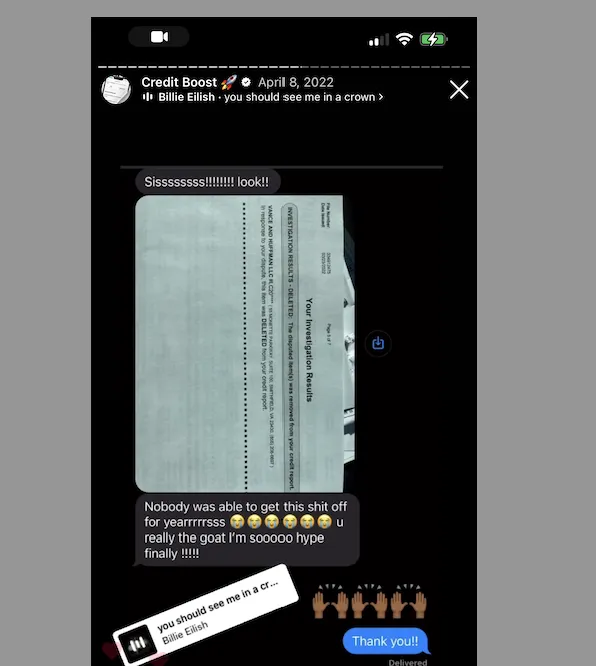

Credit Saved My life!

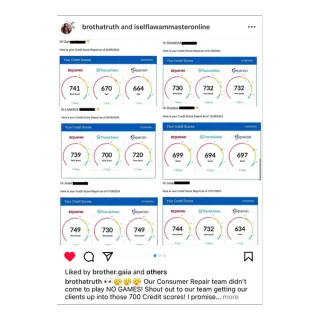

When You Join We Are

Committed to Delivering

Affordable Programs

Up-To $20,000-$250,000 in Commission free Funding Assistance

Personalized Financial Guidance

Credit Score Monitoring

Privacy and Security

Bi-Weekly FinancialEducation

Dedicated Support Team

Express Programs Available for client needing Extra Attention

Backed By 15 years of Experience & Utilizing Consumer Laws We Can Remove

Collections

Bankrupcty

Car Repo's

Evictions

Chex System & Early Warning Mistakes

Charge-offs

Tax Liens

Child Support

Student Loans

Medical Bills

Late Payments

Old Information

When You Join We Are

Committed to Delivering

Affordable Programs

Up-To $20,000-$250,000 in Commission free Funding Assistance

Personalized Financial Guidance

Credit Score Monitoring

Privacy and Security

Bi-Weekly FinancialEducation

Dedicated Support Team

Express Programs Available for client needing Extra Attention

Backed By 15 years of Experience & Utilizing Consumer Laws We Can Remove

Collections

Bankrupcty

Car Repo's

Evictions

Chex System & Early Warning Mistakes

Charge-offs

Tax Liens

Child Support

Student Loans

Medical Bills

Late Payments

Old Information

Become an affiliate get paid monthly!

Join Our Affiliate Program and Earn 30% Commission with All Roads Lead to Credit: Partner with a Results-Driven Company Offering Affordable Solutions for Your Clients' Credit Repair, Personal & Business Funding Needs!

Please fill out the form below and y'all be sent your own personalized link:

http://affiliate.allroadsleadtocredit.com

Need to check your commission payout here

Existing Client Resources

Login to your credit repair private portal:

https://www.secureclientaccess.com

Book an Monthly follow- up

http://monthlyfollowup.allroadsleadtocredit.com

Customer Support

Client Course Dashboard:

Can I book a consultation with you before signing up?

Yes! Please use the link below

Derogatory marks: what are they and how to remove them

Derogatory marks, also referred to as negative credit items, signify detrimental aspects within your credit history, such as late payments and delinquencies. These marks, alongside a poor credit rating, can impede your ability to secure credit approval or favorable credit terms.

Understanding the various types of derogatory marks is crucial as they significantly impact your financial record and your relationship with lenders. Here’s an overview of derogatory marks and their implications on your credit:

What Are Derogatory Marks?

Derogatory marks encompass negative entries indicating failure to repay a loan or being delinquent on debt, which adversely affect your credit profile over time. Their presence on your credit report serves as a warning to lenders, restricting credit approvals and diminishing your creditworthiness.

Different types of derogatory marks exist, each typically remaining on your credit report for seven years. The severity of these marks varies, with some exerting more substantial effects than others. For example, a late payment typically has less impact on credit compared to a bankruptcy filing.

Types of Derogatory Marks

Here’s a breakdown of common derogatory marks and their approximate durations on credit reports:

- Late Payments: Payments overdue by 30 days or more.

- Charge Off: Unpaid debts sent to collections after 180 days.

- Repossession: Assets like cars seized due to delinquency.

- Foreclosure: Lenders taking possession of homes due to

unpaid mortgages.

- Student Loan Delinquency: Failure to make payments, potentially leading to garnishments.

- Bankruptcy: Legal process for debt settlement, affecting credit for 7-10 years.

- Debt Settlement: Negotiated reduction of debts, affecting credit for 7 years.

Impact on Credit

Derogatory marks can significantly lower your credit score and diminish your credibility with lenders, complicating loan approvals or favorable terms. The number of derogatory marks correlates with lower credit scores and increased perceived credit risk.

Recent credit history also influences the impact of derogatory marks. For instance, consistent on-time payments over a few years hold more weight than a repossession several years prior. Conversely, recent negative marks carry more weight than older ones.

Removing Derogatory Remarks:

You can dispute inaccurate derogatory marks with creditors or credit bureaus. Alternatively, for accurate marks, you can wait for them to expire or request removal through a goodwill letter, especially if you have a history of timely payments. While creditors aren't obligated to remove accurate derogatory marks, they may consider it under certain circumstances.

In summary, understanding derogatory marks and their effects on credit, coupled with proactive measures to address them, can help maintain a healthy credit profile.

How long does the process take if I purchase a Monthly program?

The duration of the process depends on several factors, such as the contents of your credit reports, the presence of negative items, the age of information on your reports, and any public records. Each client's situation is unique, and the timeframe is determined after a thorough evaluation of their credit reports.

It's important to note that when enrolling in a monthly program, many clients begin to see results within the first 3 to 6 months. However, even if your report becomes clean during this period, you are still responsible for completing the payment plan you initially signed up for. The monthly program operates on a perpetual payment basis, providing clients who are unable to make upfront payments with a convenient payment plan option.

How long does the process take if I purchase a Express program?

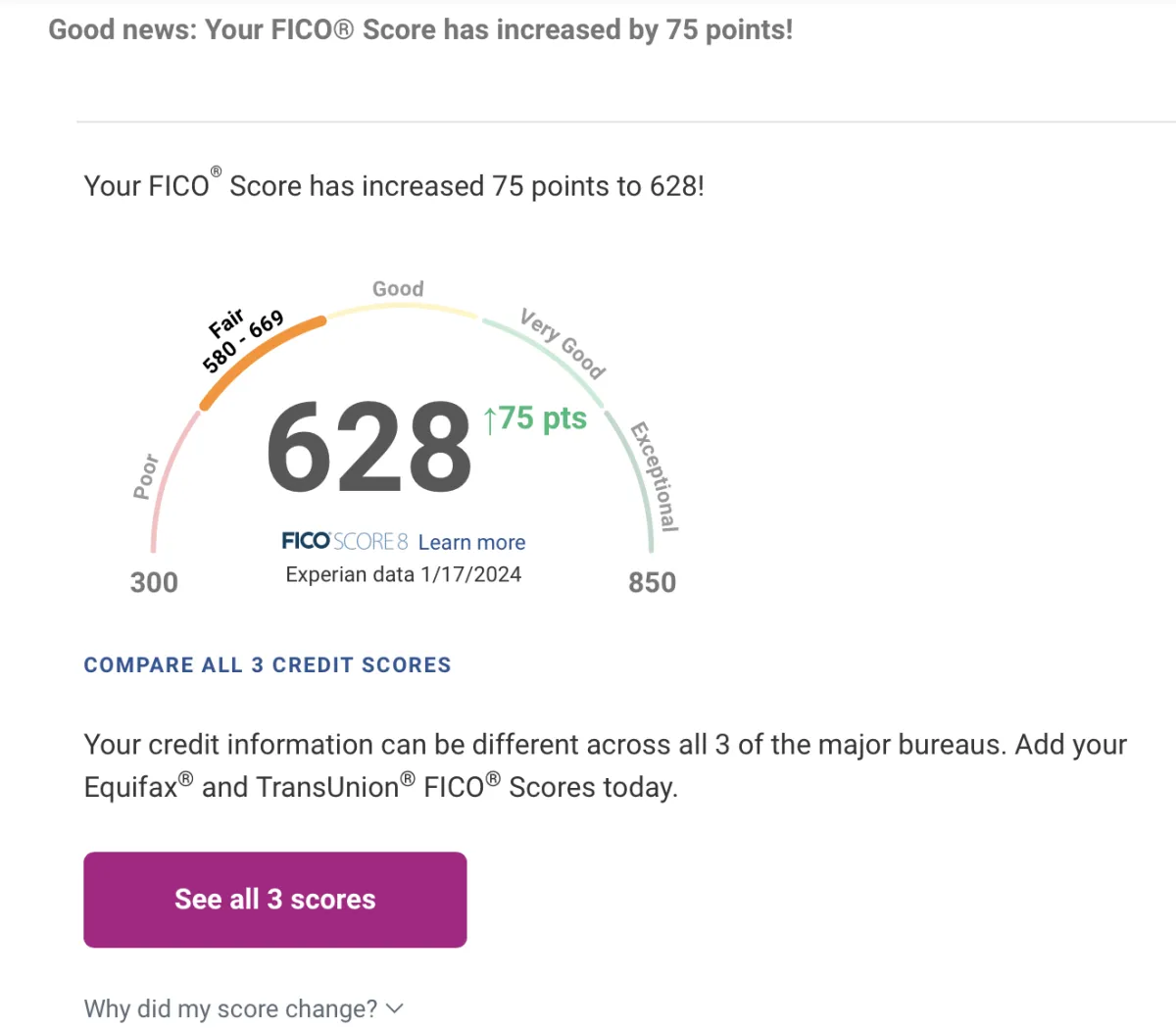

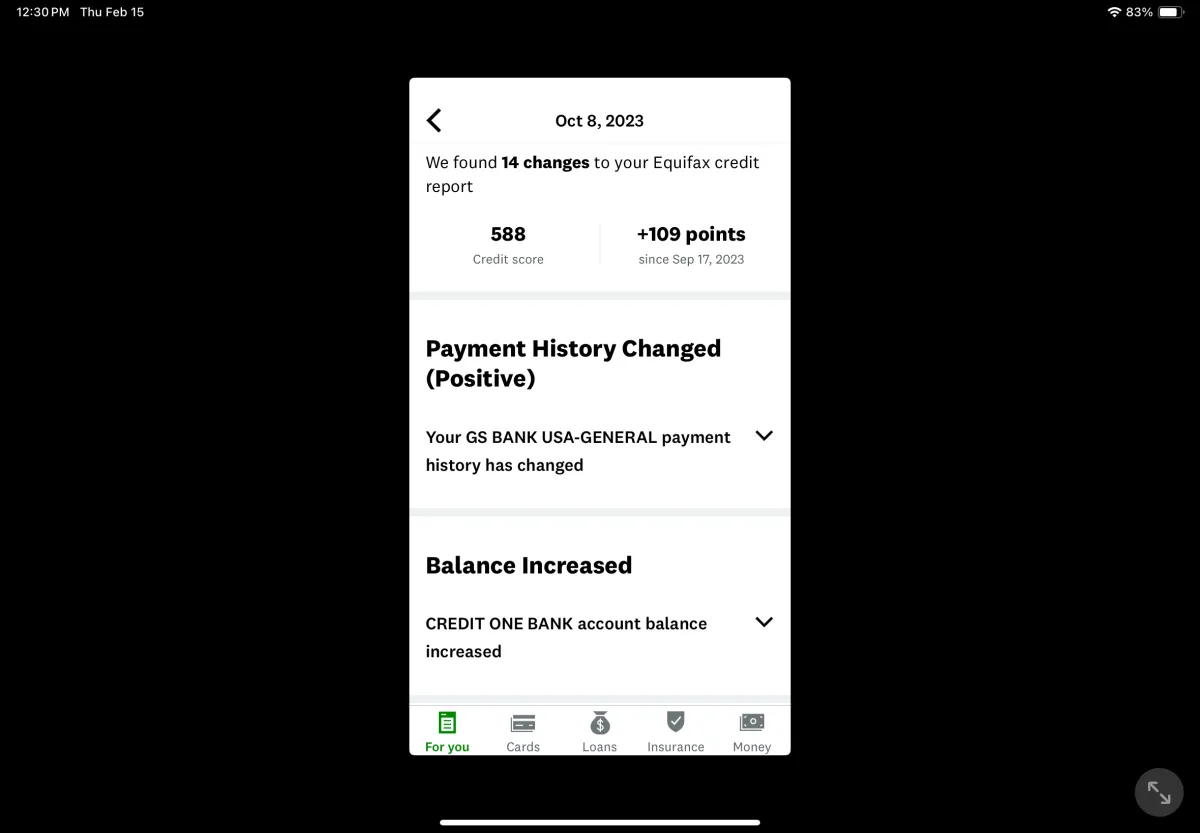

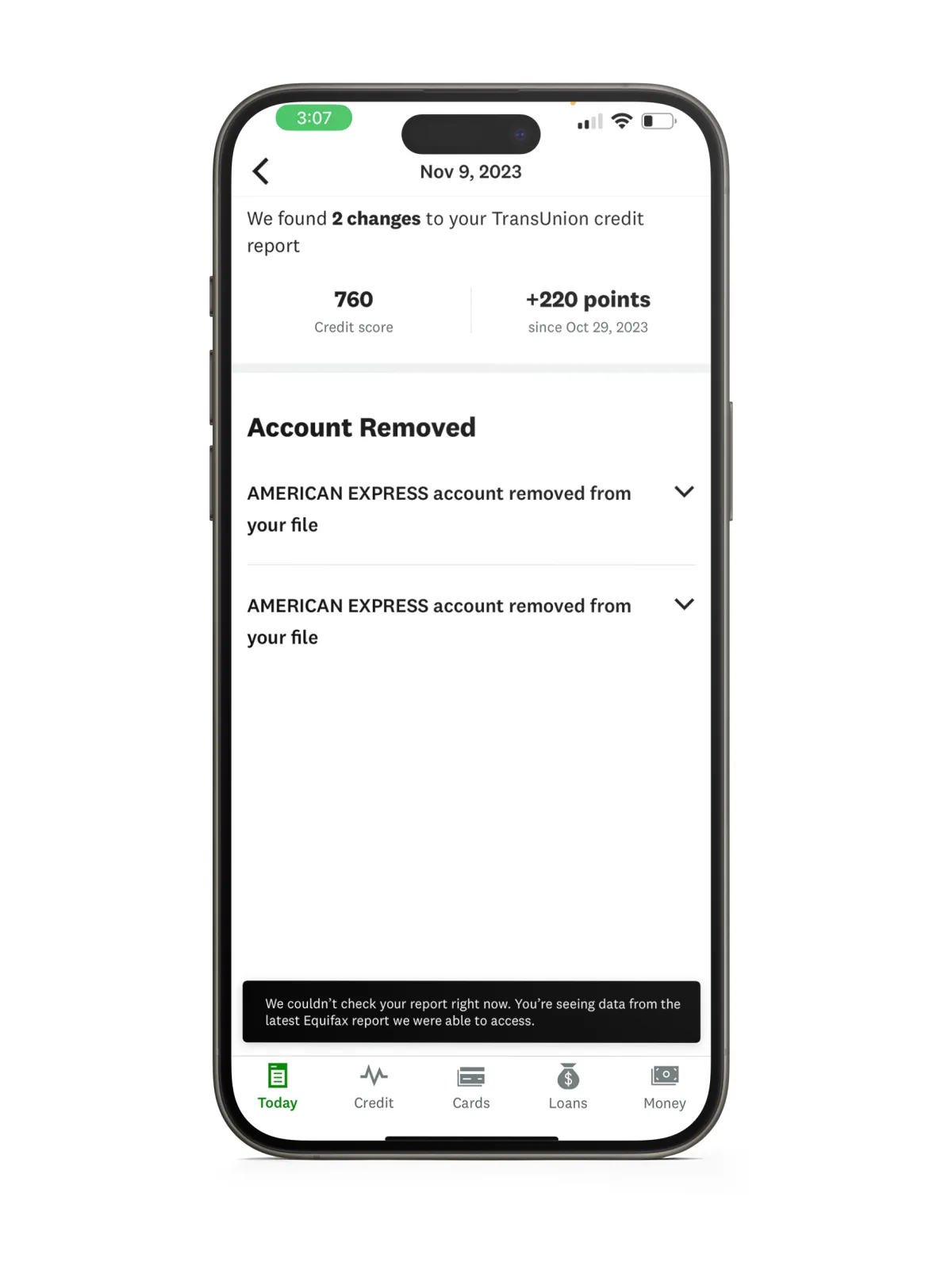

With the Express Program, you can expect significant improvements in your credit reports, typically achieving a 75% clean-up within 45 to 90 days. However, the exact timeframe may vary depending on the specific issues affecting your credit reports, including any public records involved. In some cases, the process may extend up to 6 months to ensure comprehensive resolution.When you opt for the Express plan, you're choosing the pay-up-front method, which prioritizes your reports in the queue. Misty, alongside her dedicated dispute team, will closely monitor your disputes to ensure swift and effective results. This proactive approach aims to expedite the resolution process and deliver the best outcomes for you.

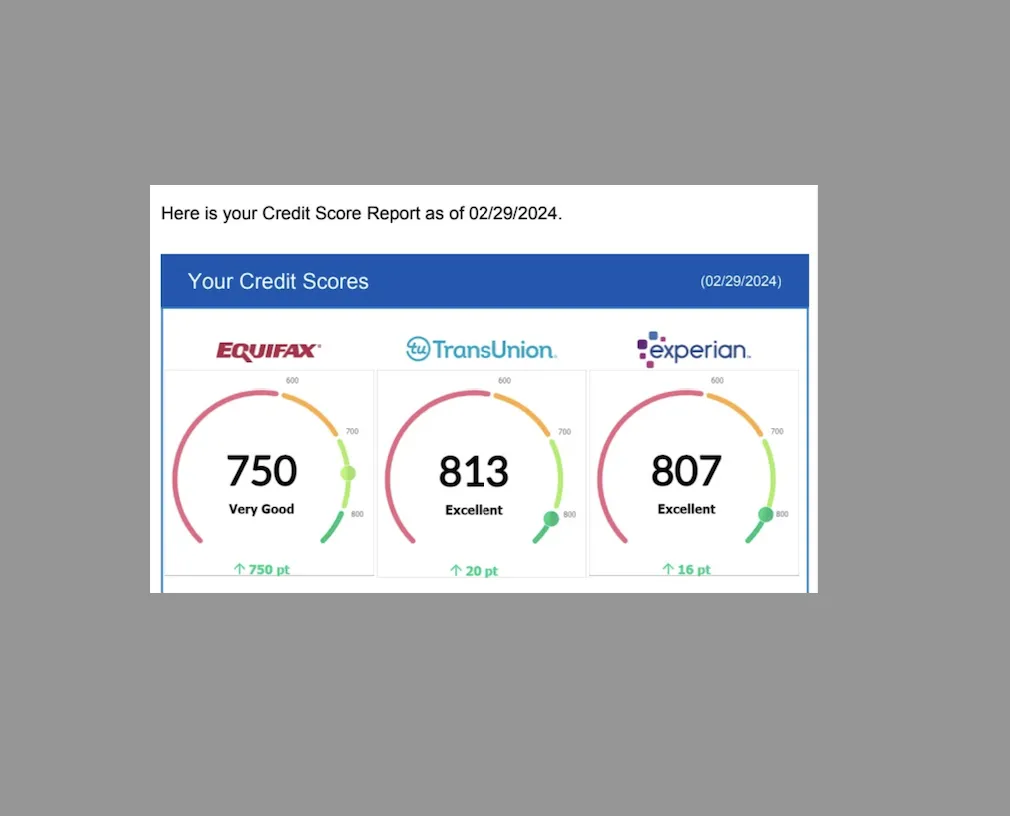

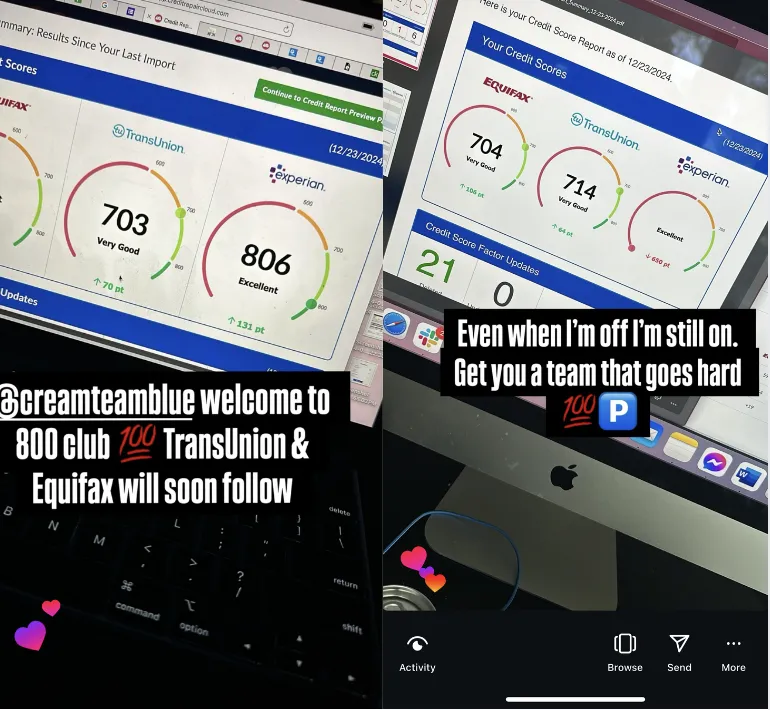

How high will my scores be once I'm done with your process?

The ultimate outcome of your credit scores after completing our process depends on several factors. Firstly, it hinges on what remains on your credit report following the removal of negative items. Additionally, it's crucial to adhere to the instructions outlined in your action plan provided by Misty.While eliminating negative items is a significant step, it's only half of the equation. To witness substantial increases in your credit scores, you'll need to take further actions such as building credit, paying down debts, and managing your finances responsibly. By following through with the recommended steps, you can maximize the potential for significant score improvements.

How will communication occur once I've enrolled in one of your programs?

Once you're enrolled, you will receive a welcome email. It's essential to thoroughly read through this email. Following that, you'll need to complete your intake form, select the appropriate credit monitoring service, and submit your identity documents. Once these steps are completed, our onboarding team will initiate the onboarding process.

Typically, this process should only take 24-48 hours if all the correct information was provided.After the onboarding process is finished, you will gain access to your private portal. For organizational purposes, we kindly request that you communicate with us exclusively through the client portal or customer service channels. Please refrain from sending dispute-related inquiries via text, as they may be overlooked.

Moreover, you'll receive links enabling you to book a complimentary 30-minute Q&A session with me monthly. Feel free to reach out with any questions or concerns via email or the client portal at any time. My team or I will respond promptly to address your inquiries.

Do you meet with clients in person?

At this time, I don't conduct in-person meetings. For my safety and personal reasons, I currently prefer digital meetings via phone or Zoom.

Do you have trade line I can purchase?

Yes, you have the option to add two tradelines at any time for an additional $1000 on top of the program you have purchased. Additionally, if you prefer to purchase tradelines separately, that's perfectly fine. I offer packages with a minimum age of 10 years and a $50,000 limit for $1500.

Can I upgrade from a personal plan to a business plan?

Yes, you can upgrade from your personal plan to a business plan. Any credit you've accrued from your personal plan will be credited towards your business plan

Can I cancel my monthly subscription?

While you can put your plan on hold if you're unable to make the payments, please note that the balance will still be owed. Our monthly subscription isn't designed to be indefinite, and we offer very low enrollment fees to accommodate individuals who may not be able to pay upfront, by providing a payment plan option.

What qualifies me for personal credit funding?

To qualify for personal credit funding, you should ideally meet the following criteria:

Maintain a 100% payment history.

Have fewer than 2 recent account-holding hard inquiries.

No collections or derogatory remarks on your credit report

Keep credit utilization below 10%

At least 3-5 active accounts that have positive reporting history for at least 6-8 months

What qualifies me for business credit funding?

To qualify for business credit funding, it's ideal to meet the following criteria:

Maintain at least $20,000 in available credit.

Hold a minimum of 2 primary credit cards

Maintain at least 3-4 open accounts.

Maintain a 100% payment history.

Have fewer than 2 recent account-holding hard inquiries.

Ensure there are no collections or derogatory remarks on your credit report.Keep credit utilization below 10%.

Can I white label your services and offer them to my clients?

Yes, please contact my directly at [email protected]

Terms & Agreement

Welcome to All Roads Lead to CreditThank you for choosing All Roads Lead to Credit ("the Company") as your credit education partner. By accessing or using our services, you agree to comply with and be bound by the following terms and conditions of use. Please read these terms carefully before using our services.

1. Acceptance of Terms By accessing or using the services provided by All Roads Lead to Credit, you agree to be bound by these terms and conditions, which establish a contractual relationship between you and the Company. If you do not agree to these terms, you may not access or use our services.

2. Services All Roads Lead to Credit offers credit education services aimed at helping individuals improve their credit scores and financial literacy. Our services include but are not limited to credit counseling, credit repair, and financial planning

.3. EligibilityTo use our services, you must be at least 18 years of age and have the legal capacity to enter into a binding contract. By using our services, you represent and warrant that you meet these eligibility requirements.

4. Privacy PolicyYour privacy is important to us. Please refer to our Privacy Policy [hyperlink to privacy policy] to understand how we collect, use, and disclose information about you.

5. Payment and Fees Payment for our services is required as outlined in your service agreement. All fees are non-refundable unless otherwise stated in the agreement. Failure to make timely payments may result in suspension or termination of services.

6. Intellectual Property All content provided by All Roads Lead to Credit, including but not limited to text, graphics, logos, images, and software, is the property of the Company and is protected by copyright and other intellectual property laws. You may not reproduce, distribute, modify, or create derivative works of our content without prior written consent

.7. Disclaimer of Warranties All Roads Lead to Credit makes no representations or warranties of any kind, express or implied, regarding the accuracy, completeness, or reliability of the information provided through our services. We do not guarantee specific results, and individual outcomes may vary

.8. Limitation of LiabilityIn no event shall All Roads Lead to Credit or its affiliates be liable for any indirect, incidental, special, or consequential damages arising out of or in connection with the use of our services.

9. Governing LawThese terms and conditions shall be governed by and construed in accordance with the laws of the State of Florida, without regard to its conflict of law provisions.

10. Changes to TermsAll Roads Lead to Credit reserves the right to modify or revise these terms and conditions at any time. Any changes will be effective immediately upon posting on our website. Your continued use of our services after the posting of any changes constitutes acceptance of those changes.

Privacy Policy

IntroductionAt All Roads Lead to Credit ("the Company"), we are committed to protecting the privacy and security of your personal information. This Privacy Policy outlines how we collect, use, and disclose information about you when you use our services

.2. Information We CollectWe may collect personal information about you when you use our services, including but not limited to:NameContact information (e.g., email address, phone number)Financial information (e.g., credit card details)Demographic information (e.g., age, gender)We may also collect non-personal information such as your IP address, browser type, and device information when you access our website.

3. Use of InformationWe may use the information we collect for the following purposes:To provide and improve our servicesTo communicate with you about your account and our servicesTo personalize your experienceTo process paymentsTo comply with legal obligations

4. Sharing of InformationWe may share your information with third-party service providers who assist us in providing our services, such as payment processors and credit bureaus. We may also share your information with law enforcement or regulatory authorities as required by law.

5. SecurityWe take reasonable measures to protect the security of your personal information and prevent unauthorized access or disclosure. However, no method of transmission over the internet or electronic storage is 100% secure, and we cannot guarantee absolute security.

6. Your ChoicesYou may choose not to provide certain personal information, but this may limit your ability to use certain features of our services. You may also opt out of receiving promotional emails from us by following the instructions in those emails.

7. Children's PrivacyOur services are not intended for children under the age of 18, and we do not knowingly collect personal information from children

8. Changes to Privacy Policy We reserve the right to modify or revise this Privacy Policy at any time. Any changes will be effective immediately upon posting on our website. Your continued use of our services after the posting of any changes constitutes acceptance of those changes.

Refund Policy

At All Roads Lead to Credit, our mission is to eliminate questionable negative information from credit reports, providing you with a path towards financial empowerment. While credit repair isn't an exact science, we stand behind our services with confidence. That's why we offer our clients the All Roads Lead to Credit 90-Day Warranty.

If you enroll in any program with All Roads Lead to Credit and don't witness the removal of any questionable items from your credit within 90 days, we guarantee a full refund.

While complete credit repair may take longer, this period should demonstrate significant progress, or your money back.To request a refund, simply reach out to your service specialist by phone for identity verification.However, to qualify for a refund under the All Roads Lead to Credit money-back guarantee, you must adhere to the following terms and conditions:

1. Eligibility for a refund begins on day 90, requiring active participation in the program for the initial 90 days. Cancellation or failure to pay during this period voids the guarantee.

2. You must refrain from adding any new derogatory trade lines to your credit report after starting the program.

3. Timely payments as per the agreement terms are essential.

4. Within five (5) days of agreement activation, provide proof of identity, such as a copy of your driver’s license and social security card.

5. Allow All Roads Lead to Credit thirty (30) days from the refund request to review your credit bureaus and account audit for verification

.6. Refund audits must be requested between days 91 and 120 from the receipt of your first payment. Continuing in the program beyond 120 days waives your refund eligibilityAt All Roads Lead to Credit, we're committed to your financial journey. Trust us to guide you towards a brighter credit future.

Contact Us

(407) 205-5468

Mailing address

4530 S Orange Blossom Trail #992

Orlando, FL 32839

Copyright © [2014] All Roads Lead to Credit. All rights reserved.